Import Advisory

Foreign Trade Zone

Unlock cost-saving advantages and mitigate the impacts of tariffs with the Foreign Trade Zone (FTZ). Reduce duties, streamline operations, and boost your business’s global competitiveness.

How It Works

Reduce and eliminate duties on foreign goods

Foreign Trade Zones (FTZs) are areas within the U.S. that offer significant benefits for international trade. Essentially, it allows your company to reduce or eliminate duties. You may not have to pay any duties at all if you end up exporting these goods, which can be a substantial cost-saving advantage. If the products are sold domestically, you can defer paying customs duties until your products are ready for the U.S. market, giving you more flexibility with cash flow and inventory management. You may even be able to reduce or eliminate duties on inputs used in manufacturing your products, whether for domestic sale or export.

To learn more, watch the International Trade Administration’s video.

Step 1

Import foreign goods or materials into the U.S.

Step 2

Receive finished goods or materials for production in the FTZ.

Step 3

Assemble or store finished product in the U.S.

Step 4

Ship final product. Duties are deferred, reduced, or eliminated.

Eligibility

Is my business eligible?

Whether you’re a small startup or an established enterprise, FTZ benefits are designed to enhance your competitive edge in global markets. Various industries can benefit from FTZ advantages, including manufacturing, distribution, logistics, and assembly.

If you’re a Utah company who imports foreign goods, let’s talk.

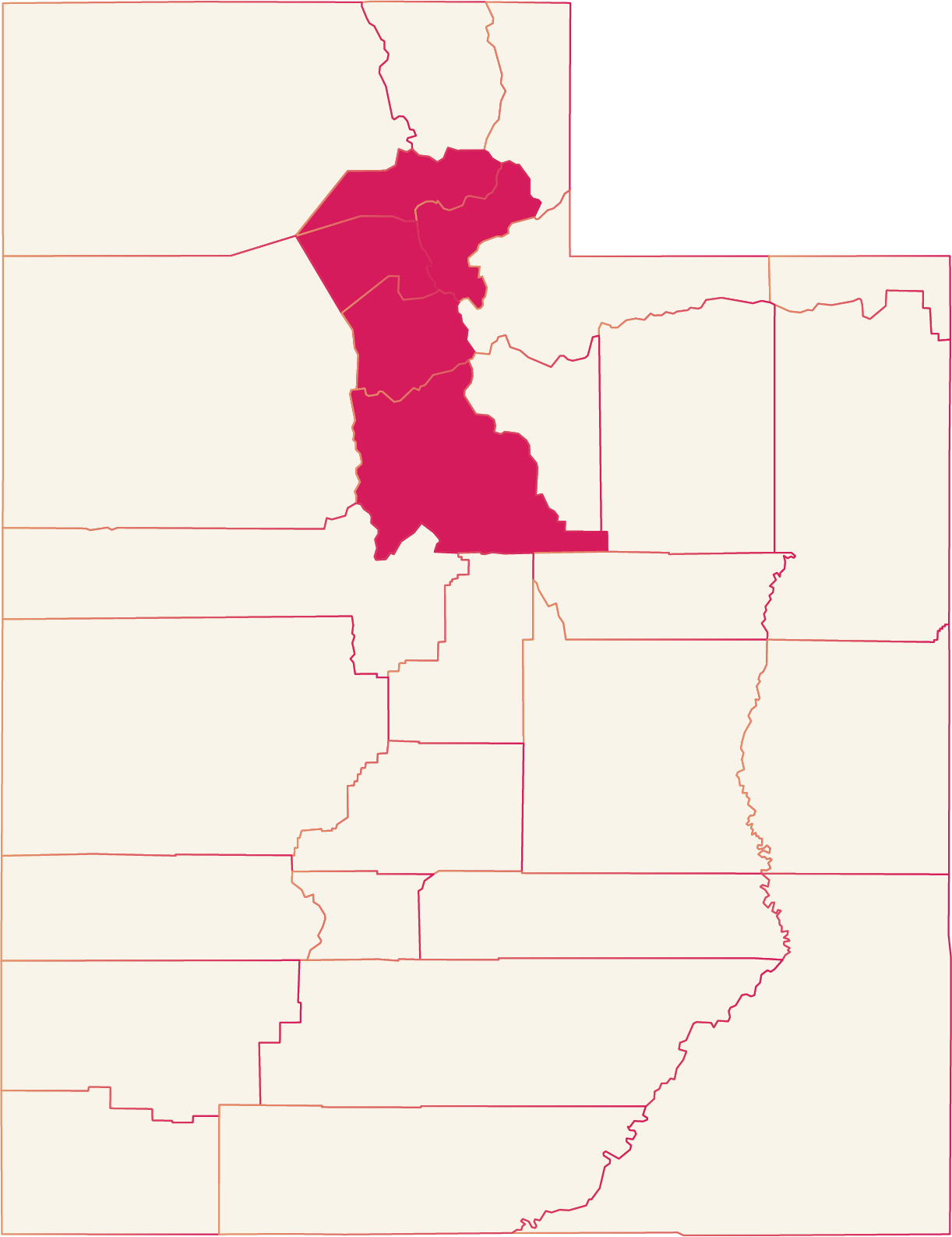

The program has limited access outside of the following counties: Davis, Morgan, Salt Lake, Weber, and Utah.

Where the full county isn’t covered, the cities of: Brigham City, Coalville, Corinne, Deer Mountain, Echo, Erda, Francis, Grantsville, Heber City, Honeyville, Henefer, Kamas, Kimball Junction, Lake Point, Mantua, Midway, Mills Junction, Oakley, Park City, Peoa, Perry, Rush Valley, Samak, Silver Summit, Snyderville, Stansbury Park, Stockton, Terra, Tooele, Vernon, Wanship, and Woodland.

About the Foreign Trade Zone

Frequently Asked Questions

If you have additional questions, please email ftz@wtcutah.com.

-

Utah businesses can benefit from the FTZ program in several ways:

Duty deferral: Duties on imported goods are deferred until they leave the FTZ for U.S. consumption.

Duty elimination: If goods are re-exported from the FTZ, no duties are paid.

Duty reduction: If the finished product has a lower duty than the raw materials that came into the zone, the duty may be lowered

Operational flexibility: Businesses can store, assemble, manufacture, and exhibit goods within the FTZ without paying duties until they are ready for sale or export.

-

Businesses interested in utilizing the FTZ program can start by contacting World Trade Center Utah. We provide guidance on the application process, requirements, and benefits of operating within the FTZ. Our team is here to support businesses every step of the way, from initial inquiry to full implementation.

-

While there are application fees and operational costs associated with FTZ usage, the potential savings from duty deferral or elimination often outweigh these expenses. World Trade Center Utah can provide detailed cost-benefit analyses at no cost and assist in navigating regulatory requirements.

-

World Trade Center Utah is now the grantee of the FTZ30, which covers many counties and cities across the Wasatch Front. We work closely with U.S. Customs and Border Protection (CBP) to ensure compliance with customs regulations and to facilitate efficient operations within the FTZ.

Contact Us

Ready to get started?

Our import advisors at are here to help. We’ll guide you through the application process, compliance requirements, and the benefits of operating within the FTZ.

To make this tool more accessible, WTC Utah can help you with a detailed cost-benefit analysis at no cost. There are application fees and operational costs associated with the FTZ program, but don’t worry — we’ll work with you to figure out all the details and guide you every step of the way.

Contact

Wayne Coleman

ftz@wtcutah.com